Hunter Biden sues IRS over tax disclosures after agent testimony

Hunter Biden sued the Internal Revenue Service on Monday.

IRS granted tax-exempt status to extremists, including Oath Keepers

By Elizabeth Schmidt, UMass Amherst When someone mentions nonprofits, chances are you picture homeless shelters, free medical clinics, museums and other groups that you believe are doing good one way or another. Most of these organizations are legitimate. But not all nonprofits are principled or embrace missions everyone considers worthy of the tax-exempt status that the […]

IRS to test own free e-filing system in ’24 pilot program

The IRS’s existing free e-file option, available to lower income taxpayers who qualify, will remain in place.

New push on US-run free electronic tax-filing system for all

It’s that time of year when throngs of taxpayers are buckling down to file their income tax returns before Tuesday’s filing deadline. Many often pay to use software from private companies such as Intuit and H&R Block. Almost one-quarter of Americans wait until the last minute to file their taxes. There could be a new, […]

Yellen tells IRS to develop modernization plan in 6 months

Now that President Joe Biden signed Democrats' expansive climate, tax and health care bill into law, Treasury Secretary Janet Yellen has directed the IRS to develop a plan within six months outlining how the tax agency will overhaul its technology, customer service and hiring processes.

Court strikes down pre-litigation jury trial waiver

A state appeals court has found that the developers of a Milwaukee townhouse project could not sign away their right to appear before a jury in a lawsuit against the bank that had provided loans for the project.

Former Madison man convicted of tax evasion

A former Madison man will be sentenced in May for tax evasion and harassing IRS agents.

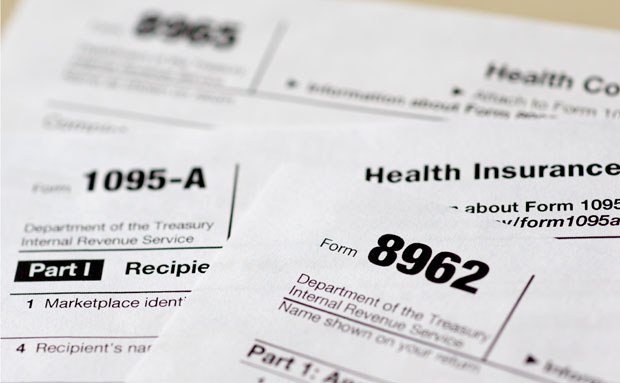

Fines about to rise for uninsured, per court decision

The cost of being uninsured in America is going up significantly next year for millions of people.

Attorney accused of hiding money from tax authorities

A Menomonee Falls attorney is accused of putting money in his trust account to hide it from tax authorities.

Menomonee Falls woman gets 30 months for tax, mail fraud

A Milwaukee-area woman has been sentenced to 30 months in prison after pleading guilty to tax, mail and food stamp fraud.

Judge dismisses anti-religious group lawsuit

A federal judge has dismissed a lawsuit filed by a Wisconsin-based group representing atheists and agnostics against the Internal Revenue Service after the IRS says it instituted a protocol for investigating tax-exempt churches and religious organizations involved in political activity.

Slow your roll(over): IRS adopts new rule on IRA indirect rollovers

Taxes remain one of the certainties in life but a new interpretation by the Internal Revenue Service could have clients – and lawyers – paying even more if they aren’t careful.

Legal News

- North Carolina man who harbored Nazi memorabilia and attacked Black and Latino men sentenced to 41 months

- Amended complaint filed in federal court against State Bar of Wisconsin seeks punitive damages

- United Healthcare suit against cancer drug distributor time-barred

- Trump’s Wisconsin visit warns of jail time if he violates a trial gag order

- Dane County court overturns residential solar decision

- Judge faces formal complaint from state board

- Bankruptcies up 16% in U.S.

- (Updated) Wisconsin law enforcement clash with pro-Palestinian Madison protestors

- Gov. Evers seeks applicants for Lafayette County Circuit Court

- Complaint against University filed by Wisconsin law firm over $1.9M given to Palestinian students

- Hush money trial judge raises threat of jail as he finds Trump violated gag order, fines him $9K

- Active shooter ‘neutralized’ outside Wisconsin middle school

WLJ People

- Power 30 Personal Injury Attorneys – Russell Nicolet

- Power 30 Personal Injury Attorneys – Benjamin Nicolet

- Power 30 Personal Injury Attorneys – Dustin T. Woehl

- Power 30 Personal Injury Attorneys – Katherine Metzger

- Power 30 Personal Injury Attorneys – Joseph Ryan

- Power 30 Personal Injury Attorneys – James M. Ryan

- Power 30 Personal Injury Attorneys – Dana Wachs

- Power 30 Personal Injury Attorneys – Mark L. Thomsen

- Power 30 Personal Injury Attorneys – Matthew Lein

- Power 30 Personal Injury Attorneys – Jeffrey A. Pitman

- Power 30 Personal Injury Attorneys – William Pemberton

- Power 30 Personal Injury Attorneys – Howard S. Sicula