Foley & Lardner assists Milwaukee Bucks with NFT launch

By: WISCONSIN LAW JOURNAL STAFF//July 30, 2021//

Foley & Lardner assists Milwaukee Bucks with NFT launch

By: WISCONSIN LAW JOURNAL STAFF//July 30, 2021//

By Michaela Paukner

Even before the Milwaukee Bucks made history by winning the 2021 NBA title, the franchise was already making history in the digital world.

In June, the Bucks became the third NBA team to launch their own non-fungible tokens, known as NFTs, with the help of the lawyers at Foley & Lardner.

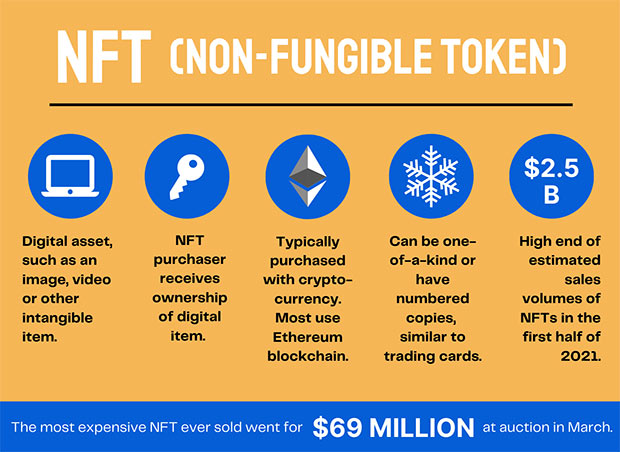

NFTs are digital assets that can be bought and sold through online marketplaces, usually with cryptocurrency. They’re intangible items, such as images or videos, and they’re becoming increasingly popular with collectors.

In the first half of 2021, estimated sales volumes of NFTs ranged from $1.3 billion to $2.5 billion. A composite of digital images by the artist Beeple sold for a record-breaking $69.3 million at auction in March. Now, more companies are attempting to cash in on these collectables by creating their own NFTs.

The Bucks’ 1971 Championship NFT Collection consists of three digital collectables: a digital replica of a World Championship banner, a Game 3 ticket and a Game 7 ticket. The banner and one of the digital tickets also include tickets to coming Bucks games. According to the listings on NFT marketplace OpenSea, all three items have been purchased. The banner now has a list price of 2,000 of the cryptocurrency Ethereum, which equates to approximately $4.6 million.

The process of minting an NFT is more than just choosing an image or video. Kevin Schulz, partner at Foley & Lardner, and Catherine Zhu, special counsel at the firm, have been helping the Bucks and other clients with the legalities of setting up and selling NFTs.

Zhu works with startups and other companies that aim to be innovative with NFT marketplaces. She said they come to her for guidance about how to make their product a digital reality.

“The distinguishing factor of NFTs is the scope of legal issues is so vast,” Zhu said. “There’s definitely more gray area on the IP issues. There are securities laws we have to look into, potential money-transmission regulatory issues. It’s definitely a broader bucket of regulatory issues.”

Schulz’s clients, meanwhile, are the sports teams, colleges and other businesses trying to make the most of the digital-collectable market. These “institutional” clients are asking what an NFT is from the legal perspective.

“Those can be very fact-specific inquiries,” Schulz said. “It’s not necessarily a one-size-fits-all answer. There are potential bankruptcy analyses, other financing considerations, insurance.”

Both attorneys have been turning to other Foley lawyers to help answer questions that deal with a particular practice specialty, even if the lawyers don’t directly work with NFTs. Their collective knowledge allows Zhu and Schulz to provide advice on legal issues for new platforms and technology.

“A lot of it is applying your traditional legal principles to the new, evolving technologies, which isn’t always an exact fit,” Zhu said. “It’s very interesting. A lot of the work that Kevin and I have done (for NFT clients), a lot of the value has been being able to apply existing laws to new technology.”

As NFTs are becoming more popular, regulation and attorneys are starting to catch up too. Standard practices are emerging for licensing and other terms. Federal agencies, such as the Federal Trade Commission and the Securities and Exchange Commission, are paying more attention to cryptocurrency and other digital assets, a trend which Zhu predicts will result in more regulation.

Consumers will likely see NFTs and blockchain technology, which is used to record digital transactions, become part of standards transactions and relationships going forward, Schulz said. Some companies are already considering using NFTs for things like event ticketing to prevent counterfeiting.

On the legal side, this shift will require lawyers for NFT platforms and companies to come together to create terms that are agreeable to all.

“(We’re) trying to find that right balance between protecting the NFT issuer’s versus the platform’s tolerance for risk and negotiating so that everyone’s comfortable with the allocation of risk and responsibilities going forward with that NFT transaction,” Schulz said.

Legal News

- State Bar of Wisconsin names election winners

- Protests erupt on college campuses throughout Midwest, and U.S. over war in Gaza

- Newly filed report with federal court seeks Havana Syndrome transparency

- Questions of transparency, leadership responsibility linger over State Bar trust

- Firm demands $4.3M in dispute with Wisconsin client

- Chesebro among those charged with interfering in 2020 election

- FTC hits Williams-Sonoma with ‘record civil penalty’ for Made in America claims

- Harvey Weinstein due back in court, while a key witness weighs whether to testify at a retrial

- Flight attendant indicted in attempt to record minor in airplane bathroom

- Wisconsin attorney loses law license, ordered to pay $16K fine

- Former Wisconsin police officer charged with 5 bestiality felony counts

- Judge reject’s Trump’s bid for a new trial in $83.3 million E. Jean Carroll defamation case

WLJ People

- Power 30 Personal Injury Attorneys – Russell Nicolet

- Power 30 Personal Injury Attorneys – Benjamin Nicolet

- Power 30 Personal Injury Attorneys – Dustin T. Woehl

- Power 30 Personal Injury Attorneys – Katherine Metzger

- Power 30 Personal Injury Attorneys – Joseph Ryan

- Power 30 Personal Injury Attorneys – James M. Ryan

- Power 30 Personal Injury Attorneys – Dana Wachs

- Power 30 Personal Injury Attorneys – Mark L. Thomsen

- Power 30 Personal Injury Attorneys – Matthew Lein

- Power 30 Personal Injury Attorneys – Jeffrey A. Pitman

- Power 30 Personal Injury Attorneys – William Pemberton

- Power 30 Personal Injury Attorneys – Howard S. Sicula