Former IRS Employee pleads guilty to money laundering

By: WISCONSIN LAW JOURNAL STAFF//December 7, 2023//

Former IRS Employee pleads guilty to money laundering

By: WISCONSIN LAW JOURNAL STAFF//December 7, 2023//

A Tennessee man pleaded guilty Tuesday in connection with a scheme to defraud the Economic Injury Disaster Loan (EIDL) program, a federal stimulus program authorized to provide loans to small businesses experiencing substantial financial disruptions due to the COVID-19 pandemic as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, according to Justice Department officials.

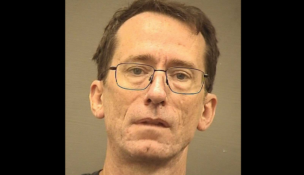

According to court documents, Brian Saulsberry, 47, of Memphis, was employed by the IRS as a Program Evaluation and Risk Analyst in the Human Capital Office. Saulsberry submitted false EIDL applications and obtained $171,400 in loan funds. After obtaining the fraudulent loan funds, Saulsberry transferred the funds to his personal checking account. He then used the loan funds for purposes not authorized by the EDIL program, but instead transferred $100,000 to an investment account, knowing that the property involved in the transaction was derived from unlawful activity.

Saulsberry pleaded guilty to one count of money laundering. He is scheduled to be sentenced on April 5, 2024, and faces a maximum penalty of 10 years in prison. A federal district court judge will determine any sentence after considering the U.S. Sentencing Guidelines and other statutory factors.

Acting Assistant Attorney General Nicole M. Argentieri of the Justice Department’s Criminal Division, U.S. Attorney Kevin G. Ritz for the Western District of Tennessee, Treasury Inspector General for Tax Administration (TIGTA) J. Russell George, and Inspector General Hannibal “Mike” Ware of the Small Business Administration Office of Inspector General (SBA-OIG) made the announcement.

TIGTA and SBA-OIG investigated the case.

Trial Attorney Thomas D. Campbell and Assistant Chief Justin M. Woodard of the Criminal Division’s Fraud Section and Assistant U.S. Attorney Carroll L. André III for the Western District of Tennessee are prosecuting the case.

This case was brought as part of an interagency effort to combat and prevent CARES Act fraud by federal employees. In October 2022, the Justice Department announced charges against five former IRS employees for defrauding federal COVID-19 relief programs. All five defendants have been convicted, officials noted.

On May 17, 2021, the Attorney General established the COVID-19 Fraud Enforcement Task Force to marshal the resources of the Justice Department in partnership with agencies across government to enhance efforts to combat and prevent pandemic-related fraud. The task force bolsters efforts to investigate and prosecute the most culpable domestic and international criminal actors and assists agencies tasked with administering relief programs to prevent fraud by, augmenting and incorporating existing coordination mechanisms, identifying resources and techniques to uncover fraudulent actors and their schemes, and sharing and harnessing information and insights gained from prior enforcement efforts. For more information on the department’s response to the pandemic, please visit www.justice.gov/coronavirus.

Anyone with information about allegations of attempted fraud involving COVID-19 can report it by calling the Justice Department’s National Center for Disaster Fraud (NCDF) Hotline via the NCDF Web Complaint Form at www.justice.gov/disaster-fraud/ncdf-disaster-complaint-form.

Legal News

- Wisconsin law enforcement clash with pro-Palestinian Madison protestors

- Gov. Evers seeks applicants for Lafayette County Circuit Court

- Hush money trial judge raises threat of jail as he finds Trump violated gag order, fines him $9K

- Audit finds Wisconsin Capitol Police emergency response times up, calls for better tracking

- Jury finds Wisconsin man sane in sexual assault, killing of toddler

- Attorney sentenced to 20 years in prison for sexually exploiting numerous children

- UW-Madison pro-Palestine protesters spark debate over free speech laws

- DEA to reclassify marijuana in a historic shift

- Wisconsin opens public comment on constitutional amendment regarding election officials

- Court upholds Milwaukee police officer’s firing for posting racist memes

- FCC fines wireless carriers millions for sharing user locations without consent

- Wisconsin Supreme Court scheduled to hear oral arguments in absentee voting case

WLJ People

- Power 30 Personal Injury Attorneys – Russell Nicolet

- Power 30 Personal Injury Attorneys – Benjamin Nicolet

- Power 30 Personal Injury Attorneys – Dustin T. Woehl

- Power 30 Personal Injury Attorneys – Katherine Metzger

- Power 30 Personal Injury Attorneys – Joseph Ryan

- Power 30 Personal Injury Attorneys – James M. Ryan

- Power 30 Personal Injury Attorneys – Dana Wachs

- Power 30 Personal Injury Attorneys – Mark L. Thomsen

- Power 30 Personal Injury Attorneys – Matthew Lein

- Power 30 Personal Injury Attorneys – Jeffrey A. Pitman

- Power 30 Personal Injury Attorneys – William Pemberton

- Power 30 Personal Injury Attorneys – Howard S. Sicula