Competing tax plans represent sharp divide in State’s 2023-25 budget

By: WISCONSIN LAW JOURNAL STAFF//April 18, 2023//

Competing tax plans represent sharp divide in State’s 2023-25 budget

By: WISCONSIN LAW JOURNAL STAFF//April 18, 2023//

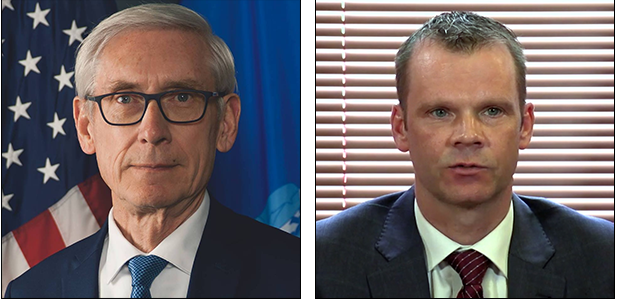

Competing income tax plans between Gov. Tony Evers and Senate Majority Leader Devin LeMahieu represent one of the sharpest disagreements in the debate over the 2023-25 state budget, according to a newly released report by The Wisconsin Policy Forum.

However, according to the report, “both plans exert their biggest impact on taxpayers at the very highest income levels.”

“In goals and approach, the two proposals diverge as far as almost any two major tax proposals in memory at the Wisconsin Capitol. The Evers plan in particular aims to increase tax credits for low and middle-income taxpayers to either lower their tax liability or increase credit payments for those who currently owe no income taxes. The governor’s plan would also raise taxes on certain taxpayers, generally those with higher incomes, and would keep overall income tax collections essentially flat,” The Wisconsin Policy Forum said in a written statement.

However, LeMahieu’s plan would eliminate the state’s current series of income tax rates that increase along with filers’ income and replace them with a single flat rate for all income, according to the statement.

“That would lower income taxes for all filers with a current tax liability but deliver greater benefits to those with higher incomes, lowering overall state tax collections by $5 billion in fiscal year 2027,” the statement said.

According to the report, the “common thread of both tax plans” is their most pronounced effects would be on those with more than $1 million in Wisconsin adjusted gross income.

“With the state enjoying its largest budget surplus on record, the upcoming 2023-25 state budget could see significant changes to Wisconsin’s income tax, which was the first effective model in the nation,” the statement added.

Both the Evers and LeMahieu plans are unlikely to become law. Top GOP legislators have rejected the governor’s proposal outright and the Republican leaders of the Joint Finance Committee have also said they do not think they can approve the flat tax plan as it has been proposed, the statement said.

To view the complete report, click here.

Legal News

- NFL is liable for $4,707,259,944.64 in ‘Sunday Ticket’ case

- Milwaukee Police investigating fatal downtown crash

- Milwaukee drops security personnel ordinance

- Wisconsin Supreme Court tacks on additional months to already suspended lawyer

- Supreme Court: Abortion protester’s First Amendment rights violated

- These doctors were censured. Wisconsin’s prisons hired them anyway

- Ruling reinstates lawsuit over ‘Black Lives Matter’ school posters

- Wisconsin Supreme Court to consider whether 175-year-old law bans abortion

- Wisconsin man facing bestiality and felony bail jumping charges

- Waukesha County woman indicted in National Health Care Fraud Law Enforcement Action

- Man sentenced to 15 months for fraud involving luxury vehicles

- Wisconsin Department of Justice Fire Marshal investigating fire that killed six

Case Digests

- Termination of Parental Rights

- First Amendment Rights

- Termination of Parental Rights

- Late Filing

- Real Estate-Attorney Fees

- Ineffective Assistance of Counsel

- Variance-Interpretation of Zoning Ordinances

- Sentencing

- Fourteenth Amendment’s Due Process Clause-Jury Instructions

- Unlawful Collection Practices-Evidence

- Sentencing-Vindictiveness

- Prisoner Grievances-Exhaustion of Administrative Remedies