‘Set up for failure,’ student debt forgiveness not likely to lighten debt load

By: Ali Teske//June 14, 2022//

‘Set up for failure,’ student debt forgiveness not likely to lighten debt load

By: Ali Teske//June 14, 2022//

“You’re set up for failure,” said Jaclyn Kallie as she reflected on her student loans.

Even though she eventually found work at Gimbel, Reilly Guerin & Brown after graduating from Marquette Law School in 2012, she has only seen interest continue to piling up on her initial loan balance of about $140,000.

“I’ve been making payments for almost 10 years, but my loan amount has gone up,” Kallie said.

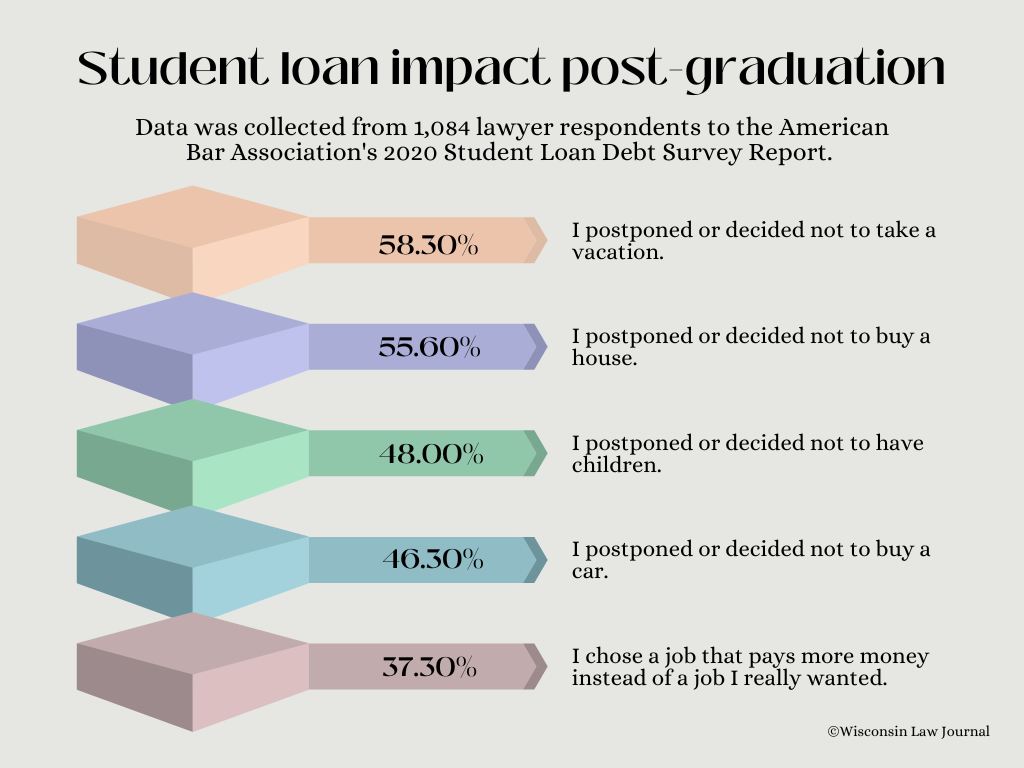

It’s a complaint that’s bound to seem familiar to many law school graduates. According to the American Bar Association Student Loan Debt survey, 95% of lawyers have taken out loans to pay for school. Their average debt balance: $164,742, a figure that includes undergraduate loans at the time of graduation.

“My personal story is that when I got out, I tried to do the standard repayment for almost two years,” Kallie said. “I had $900 in interest a month. I was throwing a minimum of $2,000 a month to try and make a dent. It was pretty crazy trying to not spend money on anything — lowering my grocery bill, not going out. I wasn’t really living. I signed up eventually for the income-based repayment program.”

President Joe Biden’s administration and the U.S. Department of Education have been working in recent months to provide student-loan forgiveness to certain borrowers. For example, $5.8 billion of federal student loan relief has gone to 560,000 former Corinthian Colleges students. Biden announced earlier in June that the administration was closing in on a decision to provide more widespread forgiveness of $10,000 per borrower.

Still, some question whether that would be enough.

“I don’t think at $10,000 forgiveness is going to change anything when it comes to lawyers in general because it’s such a small percentage in terms of the larger portion,” said James Miller, co-founder of bankruptcy firm Miller & Miller.

With the average student debt balance for lawyers topping $160,000, dropping it to $150,000 isn’t going to help much with monthly payments, Miller and Kallie agreed. Both attorneys referenced the income-based repayment system that law graduates most often sign on for.

“I have lawyers who request compensation packages that fit in with allowing them to have the lowest income-based repayment possible,” Miller said. “It doesn’t make sense for me to start paying them more if that increase in wages on the other side of things is going to increase their repayment more than the raise they are getting.”

Kallie echoed Miller’s point, saying “Part of the problem with this in the legal community is that the tuition amounts keep escalating so significantly, but the average salary for new lawyers is the same it was a decade ago.”

With the legal industry’s hiring market remaining hot, 79% of firms reported in the 2021 Bright Insight Survey conducted by Cushman & Wakefield’s Legal Sector Advisory Group that they had been hiring new lawyers from other law firms. The number one benefit they emphasize in their recruitment efforts is work flexibility to support work-life balance, 49% of respondents reported. But to Kallie, work-life balance is a luxury afforded only to lawyers whose career choices aren’t controlled largely by student debt. She said that she had left a previous firm that had a great work-life balance to seek out a higher salary and that such considerations remain in the back of her mind still today. She said many of her former colleagues and classmates whom she still keeps in touch with have left the legal profession altogether to chase a higher salary for loan repayment.

“Even the rising costs of life right now, even a competitive firm that gives you what used to be a raise or bonus that was in line with cost of living, they can’t keep up with it because cost of living is growing exponentially,” Kallie said.

A federal moratorium on student-loan repayments, first enacted by former President Donald Trump in March 2020, was extended by Biden in August. With repayments paused, a few major loan servicers have gone out of business. Various others have become the subjects of lawsuits for deceptive policies.

“It’s become exceedingly apparent, as I talk to clients and lawyers, what they are able to do financially differently,” Miller said. “They are watching the news very closely when it comes to the Biden administration’s decision to lift the moratorium. They are all hoping that there will be a greater loan forgiveness.”

Current inflation and rising costs are meanwhile adding further impediments to lawyers’ ability to repay loans. Miller said he’s now worried about will happen should the federal moratorium eventually be lifted.

“I fear that the mindset has changed from, you know, ‘I have to pay this back’ to more of an optional mindset which (borrowers) still have the legal obligation to do it. I’m looking at that $10,000 forgiveness to see if it’s a carrot dangled out there to encourage people to start paying the loans again,” he said. “The default rate once they come back is going to be very high.”

For lawyers, heavy debts can affect not only their daily spending but also their mental health, especially if they fear their debt burdens have grown too great to pay down in their lifetimes. The ABA’s survey did not asks specific questions about what debts were doing to lawyers’ mental health. But the lawyers who responded cited their mental health as the thing most affected by heavy debts.

“It makes you question your life choices a little bit,” Kallie said. “I wish that someone would have had a real talk with me before I signed up for all this.”

Legal News

- State Bar leaders remain deeply divided over special purpose trust

- Former Wisconsin college chancellor fired over porn career is fighting to keep his faculty post

- Pecker says he pledged to be Trump campaign’s ‘eyes and ears’ during 2016 race

- A conservative quest to limit diversity programs gains momentum in states

- Wisconsin prison inmate pleads not guilty to killing cellmate

- Waukesha man sentenced to 30 years for Sex Trafficking

- 12-year-old shot in Milwaukee Wednesday with ‘serious injuries’

- Milwaukee man convicted of laundering proceeds of business email compromise fraud schemes

- Giuliani, Meadows among 18 indicted in Arizona fake electors case

- Some State Bar diversity participants walk away from program

- Wisconsin court issues arrest warrant ‘in error’ for Minocqua Brewing owner

- Iranian nationals charged cyber campaign targeting U.S. Companies

WLJ People

- Power 30 Personal Injury Attorneys – Russell Nicolet

- Power 30 Personal Injury Attorneys – Benjamin Nicolet

- Power 30 Personal Injury Attorneys – Dustin T. Woehl

- Power 30 Personal Injury Attorneys – Katherine Metzger

- Power 30 Personal Injury Attorneys – Joseph Ryan

- Power 30 Personal Injury Attorneys – James M. Ryan

- Power 30 Personal Injury Attorneys – Dana Wachs

- Power 30 Personal Injury Attorneys – Mark L. Thomsen

- Power 30 Personal Injury Attorneys – Matthew Lein

- Power 30 Personal Injury Attorneys – Jeffrey A. Pitman

- Power 30 Personal Injury Attorneys – William Pemberton

- Power 30 Personal Injury Attorneys – Howard S. Sicula