GOP leader proposes flat income tax; Evers opposes

The Republican leader of the Wisconsin state Senate plans to propose Friday moving to a 3.25% flat income tax rate, a roughly $5 billion proposal that Democratic Gov. Tony Evers has vowed to block.

New laws take effect across US on abortion, policing, taxes

Minimum wage increases, animal protections, police accountability, cutting and increasing taxes are all part of a series of new laws taking effect across the country on Saturday, the first day of 2022.

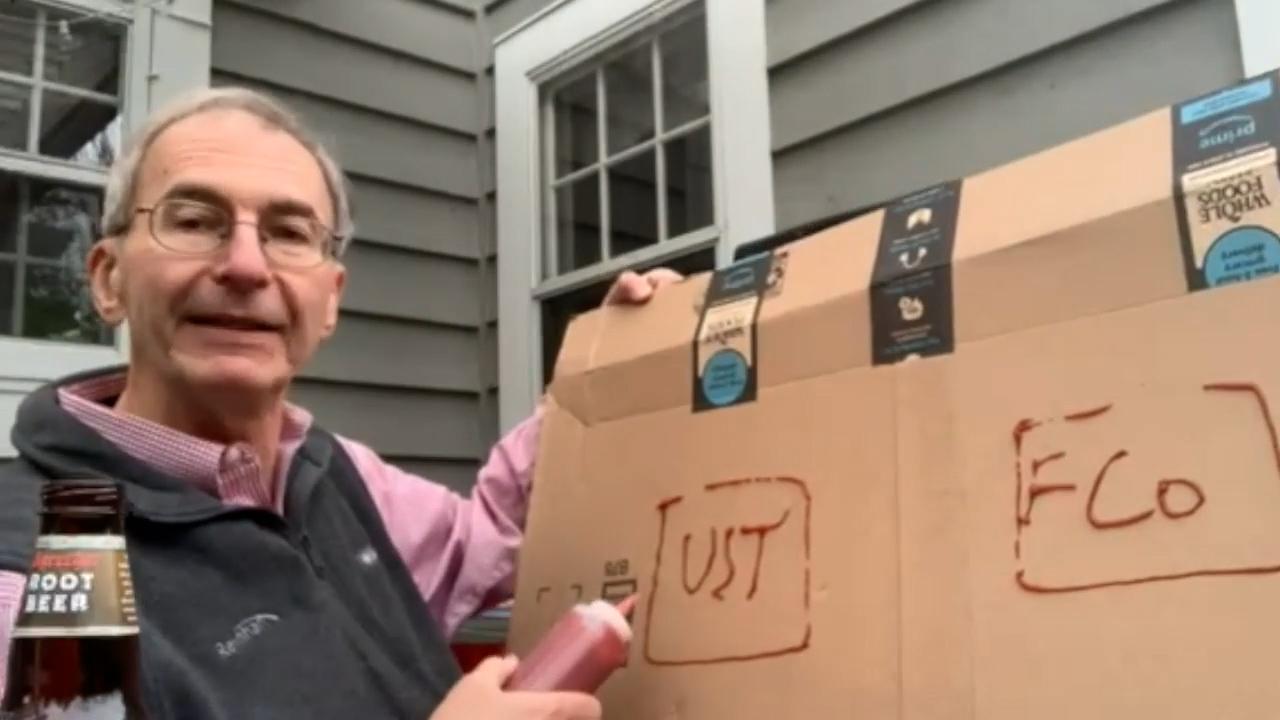

Reinhart’s Misey steps before camera to spread word of tax expertise

To show just how unwieldy and dense the federal tax code has become, Robert Misey recently tried to blow up the 6th volume of his IRS regulations using three rounds of fire crackers.

Lingering limbo: Businesses uncertain about tax law impact

Five months after massive federal tax changes became law, many small business owners still don't know whether they'll be winners or losers.

CLOSING ARGUMENTS: Getting down to tax

Looking for a way to raise money for various road and building projects without raising the property tax levy, Brown County officials last year enacted an ordinance instituting a 0.5 percent local sales and use tax.

View from around the state: Don’t run up the deficit for a tax cut

House Speaker Paul Ryan told officials at a Harley-Davidson motorcycle factory in Menomonee Falls last week that Congress is moving "full throttle on tax reform."

Federal court bans Appleton tax preparer

A federal court has barred an Appleton tax preparer and his firm from doing federal tax returns for others.

Man charged with filing false tax return

A Waunakee man has been charged with filing a false tax return for the 2009 tax year.

BEV BUTULA: Tax season doesn’t have to be taxing

With tax season upon us, many legal researchers search for basic tax rates and schedules.

Federal reform would make firms pay taxes on unrealized income

Many law firms would have to switch their accounting methods and pay taxes on income before the money actually is collected, if a proposed federal tax reform makes its way through Congress.

Bankruptcy Court judges split over state tax dischargeability

Lawyers say a split in the U.S. Bankruptcy Court over whether tax liability from late-filed state income tax returns are dischargeable in bankruptcy is creating uncertainty and making it difficult to advise debtors on how to proceed.

Audits more likely for recent family business transactions

Family business owners who worked frantically to offload company shares to the next generation of owners in the months leading up to the New Year can breathe easier now that Congress passed a law to avert anticipated tax rate increases and tax-exempt gift limits. But CPAs and attorneys warn the work isn’t over quite yet.

Legal News

- Wisconsin attorney loses law license, ordered to pay $16K fine

- Former Wisconsin police officer charged with 5 bestiality felony counts

- Judge reject’s Trump’s bid for a new trial in $83.3 million E. Jean Carroll defamation case

- Dozens of deaths reveal risks of injecting sedatives into people restrained by police

- The Latest: Supreme Court arguments conclude in Trump immunity case

- Net neutrality restored as FCC votes to regulate internet providers

- Wisconsin Attorney General asks Congress to expand reproductive health services

- Attorney General Kaul releases update at three-year anniversary of clergy and faith leader abuse initiative

- State Bar leaders remain deeply divided over special purpose trust

- Former Wisconsin college chancellor fired over porn career is fighting to keep his faculty post

- Pecker says he pledged to be Trump campaign’s ‘eyes and ears’ during 2016 race

- A conservative quest to limit diversity programs gains momentum in states

WLJ People

- Power 30 Personal Injury Attorneys – Russell Nicolet

- Power 30 Personal Injury Attorneys – Benjamin Nicolet

- Power 30 Personal Injury Attorneys – Dustin T. Woehl

- Power 30 Personal Injury Attorneys – Katherine Metzger

- Power 30 Personal Injury Attorneys – Joseph Ryan

- Power 30 Personal Injury Attorneys – James M. Ryan

- Power 30 Personal Injury Attorneys – Dana Wachs

- Power 30 Personal Injury Attorneys – Mark L. Thomsen

- Power 30 Personal Injury Attorneys – Matthew Lein

- Power 30 Personal Injury Attorneys – Jeffrey A. Pitman

- Power 30 Personal Injury Attorneys – William Pemberton

- Power 30 Personal Injury Attorneys – Howard S. Sicula