Recent Articles from WISCONSIN LAW JOURNAL STAFF

Disability Insurance Benefits

Warnell applied for disability insurance benefits and supplemental security income under the Social Security Act in 2019.

Obama Presidential Center Location

A group known as Protect Our Parks, Inc. (POP) has been contesting the chosen location for the Obama Presidential Center in Chicago's historic Jackson Park.

Sentencing Guidelines

Liestman, who was found guilty of transporting child pornography, a violation of 18 U.S.C. § 2252(a)(1), had a previous conviction for possessing child pornography under Wisconsin law.

Hupy and Abraham celebrates 55th Anniversary

Hupy and Abraham is celebrating its 55th Anniversary this month. In the past 55 years, its staff has won over 250 awards, donated more than $1 million to thousands of worthwhile causes and has obtained over $1 billion for more than 70,000 injured clients. “We would not be able to do it without our staff […]

FBI launches criminal investigation into Key Bridge collapse

U.S. Attorney for Maryland: 'We will seek accountability for anyone who may be responsible.'

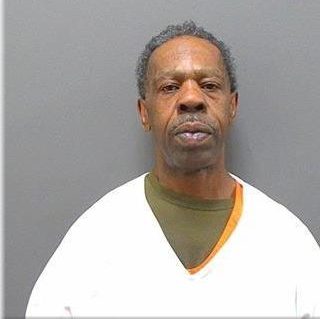

Man charged in slaying after woman’s leg found at Milwaukee-area park

Additional human remains were found April 5 and April 6.

Minnesota man guilty in fatal stabbing of teen on Wisconsin river, jury finds

Miu told investigators that he was provoked.

Wisconsin teen sentenced in bonfire explosion that burned at least 17

Armstrong was attending a bonfire on Oct. 14, 2022.

Wisconsin man who broke into home, ate victim’s chicken, slept in victim’s bed, receives prison and jail sentences

One-year prison sentence for felony bail jumping, and additional 6 months in jail for criminal trespass.

Judge refuses to dismiss Hunter Biden’s gun case

His attorneys have argued that prosecutors bowed to political pressure.

House passes reauthorization of key US surveillance program after days of upheaval over changes

The bill was approved on a bipartisan basis, 273-147.

Milwaukee Police officer traveling to Georgia training retires before facing discipline

Two other Milwaukee Police Department employees were disciplined for the same reason, but later that was reduced for revoked.

Legal News

- Gov. Evers seeks applicants for Dane County Circuit Court

- Milwaukee man charged in dismemberment death pleads not guilty

- Democratic-led states lead ban on the book ban

- UW Madison Professor: America’s child care crisis is holding back moms without college degrees

- History made in Trump New York trial opening statements

- Prosecutor won’t bring charges against Wisconsin lawmaker over fundraising scheme

- Republican Wisconsin Senate candidate says he doesn’t oppose elderly people voting

- Vice President Harris to reveal final rules mandating minimum standards for nursing home staffing

- Election workers fear threats to their safety as November nears

- Former law enforcement praise state’s response brief in Steven Avery case

- Eric Toney announces re-election bid for Fond du Lac County District Attorney

- Former Wisconsin Democratic Rep. Peter Barca announces new bid for Congress

WLJ People

- Power 30 Personal Injury Attorneys – Russell Nicolet

- Power 30 Personal Injury Attorneys – Benjamin Nicolet

- Power 30 Personal Injury Attorneys – Dustin T. Woehl

- Power 30 Personal Injury Attorneys – Katherine Metzger

- Power 30 Personal Injury Attorneys – Joseph Ryan

- Power 30 Personal Injury Attorneys – James M. Ryan

- Power 30 Personal Injury Attorneys – Dana Wachs

- Power 30 Personal Injury Attorneys – Mark L. Thomsen

- Power 30 Personal Injury Attorneys – Matthew Lein

- Power 30 Personal Injury Attorneys – Jeffrey A. Pitman

- Power 30 Personal Injury Attorneys – William Pemberton

- Power 30 Personal Injury Attorneys – Howard S. Sicula