Judge approves bid procedures in A123 bankruptcy

By: Associated Press//November 8, 2012//

By RANDALL CHASE

AP Business Writer

WILMINGTON, Del. (AP) — A judge ruled Thursday that bankruptcy proceedings for A123 Systems can move forward after the advanced battery maker reduced the fee that would have to be paid to the lead bidder for its assets should the deal fall apart.

Creditors, a U.S. trustee and the Delaware bankruptcy judge had been concerned that other bidders were being frozen out because of bid protections that could be claimed by Milwaukee-based auto-parts maker Johnson Controls Inc., the lead bidder.

Johnson Controls has bid $125 million for A123’s automotive assets. Chinese auto-parts maker Wanxiang Group is interested in buying substantially all the assets of A123, which is based in Waltham, Mass.

A123 reduced the breakup fee that would be due to JCI if it is outbid to $2.5 million, from the original $3.75 million. The expenses that JCI could recover were also reduced, from $4 million to $3 million.

A123, which has received more than $130 million in Department of Energy grants, also agreed to extend the sale process to allow other bidders, including Wanxiang, more time to put offers on the table.

A123 initially wanted a bid deadline of Nov. 16 and an auction on Nov. 19, but agreed Thursday to push the auction back to Dec. 6. A court hearing to consider approving the asset sale is set for Dec. 11.

Three years ago, A123 made its stock-market debut with a highly anticipated initial public stock offering. But since then, the company has struggled.

The government sought a way to catch up with world leaders in battery technology, South Korea and China, and helped fund the company. So did investors, who sent shares of A123 skyrocketing 50 percent on its first day of trading.

But the technology turned out to be ahead of its time. Americans continue to shun costly electric cars in favor of gasoline-powered ones.

A123 also said it would work with Wanxiang to file an application with the Committee on Foreign Investment in the United States so that a determination can be made on whether the Chinese company could pose a risk to U.S. national security.

A123, which makes lithium ion batteries for electric cars — including those made by Fisker Automotive, another recipient of DOE financial help — also makes batteries for grid storage and commercial and military applications.

Wanxiang has sought to extend the sale process in order to allow more time for regulatory approval. Uncertainty over that approval is one reason why the battery maker has pushed for a quick sale to Johnson Controls.

“Unlike Wanxiang, Johnson Controls can control its own destiny,” Timothy Pohl, a managing director of Lazard Frères & Co., testified Thursday. His firm is serving as A123’s financial adviser.

Bojan Guzina, an attorney for Wanxiang, said the company is confident that it will eventually obtain regulatory approval.

Judge Kevin Carey on Thursday also approved A123’s performance-based incentive plan for 10 senior employees, but not before the company reduced the amount of bonuses by 12.5 percent in response to objections from U.S. trustee. The trustee nevertheless maintained its objection to the plan, which had an initial estimated cost ranging from $2.4 million to $4.2 million.

Mark Kenney, an attorney for the U.S. trustee, argued Thursday that the performance goals outlined in the bonus plan were too low, virtually guaranteeing payouts, and that the plan was primarily designed to keep top employees from leaving, rather than spurring them to work harder.

Carey overruled the trustee’s objection, saying there was a rational basis for incentivizing top managers “to go all out.”

The judge also approved a retention plan estimated at about $2.4 million for 66 other A123 employees, as well as a severance plan for all of A123’s roughly 940 full-time employees to replace a plan that was in effect before the company filed for bankruptcy protection.

Legal News

- Steven Avery prosecutor Ken Kratz admits ‘mistakes were made’

- Colombian national extradited to Milwaukee faces International narcotics-trafficking conspiracy charge

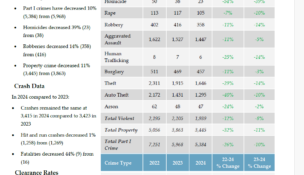

- MPD: Milwaukee homicides down nearly 40 percent compared to last year

- EVERS: Republican lawmakers No-Show at special meeting to release statewide PFAS funding, stabilize healthcare access

- Wisconsin ICAC Task Force conference on Missing and Exploited Children highlights increase in sextortion cases

- More than 300 Wisconsin officers back in law enforcement after being fired or forced out

- Former Trump staffer who said to ‘fan the flame’ after 2020 loss hired to lead Wisconsin GOP

- Gov. Evers appoints David Casey to Serve as DOR Secretary

- Former Marine sentenced for Molotov Cocktail attack against Planned Parenthood Clinic

- ABA names 34th Annual Margaret Brent Women Lawyers of Achievement Awards honorees

- FBI launches criminal investigation into Key Bridge collapse

- Man charged in slaying after woman’s leg found at Milwaukee-area park

WLJ People

- Power 30 Personal Injury Attorneys – Russell Nicolet

- Power 30 Personal Injury Attorneys – Benjamin Nicolet

- Power 30 Personal Injury Attorneys – Dustin T. Woehl

- Power 30 Personal Injury Attorneys – Katherine Metzger

- Power 30 Personal Injury Attorneys – Joseph Ryan

- Power 30 Personal Injury Attorneys – James M. Ryan

- Power 30 Personal Injury Attorneys – Dana Wachs

- Power 30 Personal Injury Attorneys – Mark L. Thomsen

- Power 30 Personal Injury Attorneys – Matthew Lein

- Power 30 Personal Injury Attorneys – Jeffrey A. Pitman

- Power 30 Personal Injury Attorneys – William Pemberton

- Power 30 Personal Injury Attorneys – Howard S. Sicula