Bankruptcies soar to near 2005 levels

By: David Ziemer, [email protected]//April 7, 2011//

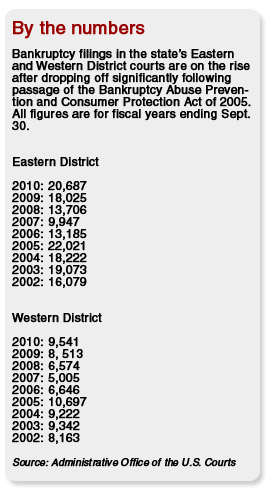

Bankruptcy filings soared in 2010 to their highest levels since 2005, the year the pending Bankruptcy Abuse Prevention and Consumer Protection Act prompted record filings in order to beat the Act’s effective date.

In the fiscal year ending Sept. 30, 2010, there were 20,687 bankruptcy filings in the Eastern District of Wisconsin, up 14.8 percent from 2009. 2010 filings were more than double the 9,947 filings in 2007, and slightly less than the record 22,021 filings in 2005.

In the Western District of Wisconsin, there were 9,541 filings in 2010, up 12.1 percent from 2009, and nearly double the 5,005 filings in 2007.

2005 also was a record year in the Western District, with 10,697 filings.

2005 also was a record year in the Western District, with 10,697 filings.

Those numbers are consistent with trends nationally. Across the country in 2010 there were 1,596,355 bankruptcy filings, up 13.8 percent from 2009. In 2007, there were only 801,269 filings nationally.

Bankruptcy Judge Margaret Dee McGarity said the numbers demonstrate the failure of the 2005 Act.

“The purpose of the Act was to make it harder to file bankruptcy and cut down on the number of bankruptcies,” she said. “But it did nothing about the reasons for bankruptcy, so it is not surprising that we are back to where we were before the law changed.”

The increased filings are keeping the bankruptcy courts busy. In 2010, the Eastern District terminated 19,265 cases, 23.4 percent more than the 15,606 terminated in 2009. In the Western District, 9,178 cases were terminated, up 20.8 percent from the 7,600 terminated in 2009.

In 2007, 9,499 cases were terminated in the Eastern District and 4,655 in the Western District.

Things may be improving, however. According to Janet Medlock, clerk of the bankruptcy court in the Eastern District, year-to-date filings were down about 8 percent during the first three months of this year.

But bankruptcy attorneys say they are as busy as they have ever been. Bruce Lanser, who has a private practice in Waukesha and also accepts appointments as trustee, says he is seeing an increase in both areas.

Lanser attributes the rise in bankruptcies to the real estate collapse, which he says affects any business that even touches the real estate market.

“The cases I’m busy with are high-end debtors, who are facing bankruptcy because of personal guarantees they made for companies that have failed or are failing,” he said. “From people who have ownership interests in many LLCs that own real estate to masons and carpenters, all are affected.”

David Ziemer can be reached at [email protected].

Legal News

- FTC bans non-competes

- Gov. Evers seeks applicants for Dane County Circuit Court

- Milwaukee man charged in dismemberment death pleads not guilty

- Democratic-led states lead ban on the book ban

- UW Madison Professor: America’s child care crisis is holding back moms without college degrees

- History made in Trump New York trial opening statements

- Prosecutor won’t bring charges against Wisconsin lawmaker over fundraising scheme

- Republican Wisconsin Senate candidate says he doesn’t oppose elderly people voting

- Vice President Harris to reveal final rules mandating minimum standards for nursing home staffing

- Election workers fear threats to their safety as November nears

- Former law enforcement praise state’s response brief in Steven Avery case

- Eric Toney announces re-election bid for Fond du Lac County District Attorney

WLJ People

- Power 30 Personal Injury Attorneys – Russell Nicolet

- Power 30 Personal Injury Attorneys – Benjamin Nicolet

- Power 30 Personal Injury Attorneys – Dustin T. Woehl

- Power 30 Personal Injury Attorneys – Katherine Metzger

- Power 30 Personal Injury Attorneys – Joseph Ryan

- Power 30 Personal Injury Attorneys – James M. Ryan

- Power 30 Personal Injury Attorneys – Dana Wachs

- Power 30 Personal Injury Attorneys – Mark L. Thomsen

- Power 30 Personal Injury Attorneys – Matthew Lein

- Power 30 Personal Injury Attorneys – Jeffrey A. Pitman

- Power 30 Personal Injury Attorneys – William Pemberton

- Power 30 Personal Injury Attorneys – Howard S. Sicula