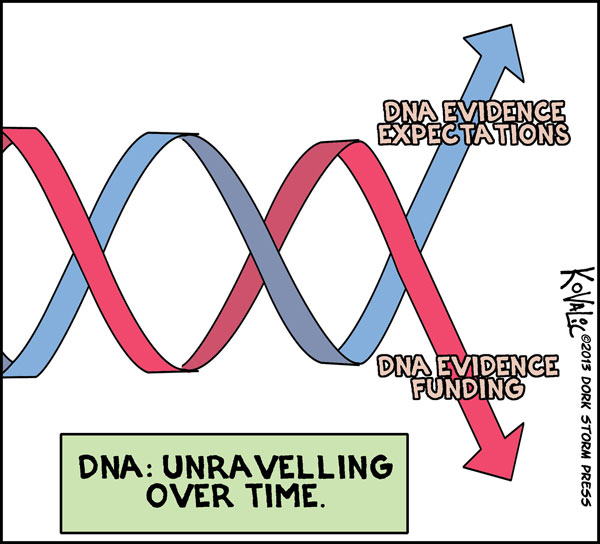

Editorial: DNA numbers don’t add up

By: WISCONSIN LAW JOURNAL STAFF//March 18, 2013//

Politicians love easy sound bites and panacea numbers, and budget season is rife with such vague points of fact.

Take Gov. Scott Walker’s proposal to expand DNA collection upon arrest. The governor has thrown around some large numbers while pitching his program: $10 million in federal grant money available and $250 surcharges to help pay for the onslaught of new genetic samples.

But those numbers don’t tell the whole story.

Yes, President Barack Obama this year signed a bill into law that will make $10 million in grants available each fiscal year from 2013 to 2015 to states that collect DNA from arrested felony suspects, as Walker has proposed. But at most, a state is eligible for grant money equal to no more than 100 percent of the first-year costs to start the program.

So, at best, federal money would cover the $2,178,100 Walker proposes spending in fiscal year 2014 to hire 16 full-time employees to process the wave of new DNA evidence. And that’s if Wisconsin somehow manages to land 22 percent of the money available to all 50 states.

That also means no federal money is coming to Wisconsin’s rescue in fiscal year 2015, when Walker proposes spending an additional $3,930,400 to hire 26 more full-time employees to process the DNA evidence.

So where will that money come from?

![]()

Walker points to his proposed expansion of the DNA surcharge assessed on felony and misdemeanor convictions. He is pushing for a $250 surcharge for felony cases and $200 for all other criminal cases.

But those surcharges only could be assessed if an arrestee is convicted of the crime. By that time, the DNA evidence has already been collected and processed, adding to the state’s bottom line.

And even for those who eventually are convicted, Wisconsin case history shows that imposing a DNA surcharge is not as simple as just tacking that figure on at sentencing. In the case of State v. Ray Shawn Cherry, for example, the Wisconsin Court of Appeals in 2008 ruled that “the trial court must do something more than stating it is imposing the DNA surcharge simply because it can.” The court went on to state, “We also do not find the trial court’s explanation that the surcharge was imposed to support the DNA database costs sufficient to conclude that the trial court properly exercised its discretion.”

Suddenly, the state’s reliance on a cure-all surcharge doesn’t sound so secure.

Now is the time to question the numbers, before the governor writes a check the state potentially can’t cash.

Legal News

- FBI launches criminal investigation into Key Bridge collapse

- Man charged in slaying after woman’s leg found at Milwaukee-area park

- Minnesota man guilty in fatal stabbing of teen on Wisconsin river, jury finds

- Wisconsin teen sentenced in bonfire explosion that burned at least 17

- Wisconsin man who broke into home, ate victim’s chicken, slept in victim’s bed, receives prison and jail sentences

- Judge refuses to dismiss Hunter Biden’s gun case

- House passes reauthorization of key US surveillance program after days of upheaval over changes

- Milwaukee Police officer traveling to Georgia training retires before facing discipline

- Evers to ask legislature to approve largest increase in state support for UW System in two decades

- 7th Circuit Court of Appeals proposes new rules

- Federal agencies allege toxic work environment for women in new report

- Wisconsin man sentenced for sex trafficking a woman and a minor online

WLJ People

- Power 30 Personal Injury Attorneys – Russell Nicolet

- Power 30 Personal Injury Attorneys – Benjamin Nicolet

- Power 30 Personal Injury Attorneys – Dustin T. Woehl

- Power 30 Personal Injury Attorneys – Katherine Metzger

- Power 30 Personal Injury Attorneys – Joseph Ryan

- Power 30 Personal Injury Attorneys – James M. Ryan

- Power 30 Personal Injury Attorneys – Dana Wachs

- Power 30 Personal Injury Attorneys – Mark L. Thomsen

- Power 30 Personal Injury Attorneys – Matthew Lein

- Power 30 Personal Injury Attorneys – Jeffrey A. Pitman

- Power 30 Personal Injury Attorneys – William Pemberton

- Power 30 Personal Injury Attorneys – Howard S. Sicula